Executive Overview of the Gas Insulated Power Equipment Market (2026–2030)

The global market for gas-insulated power equipment, covering gas-insulated switchgear (GIS), gas-insulated lines (GIL), and SF6 circuit breakers, has historically been driven by grid expansion. Urbanization, rising electricity demand, renewable integration, and the need for compact high-voltage infrastructure pushed utilities toward gas-insulated solutions for decades.

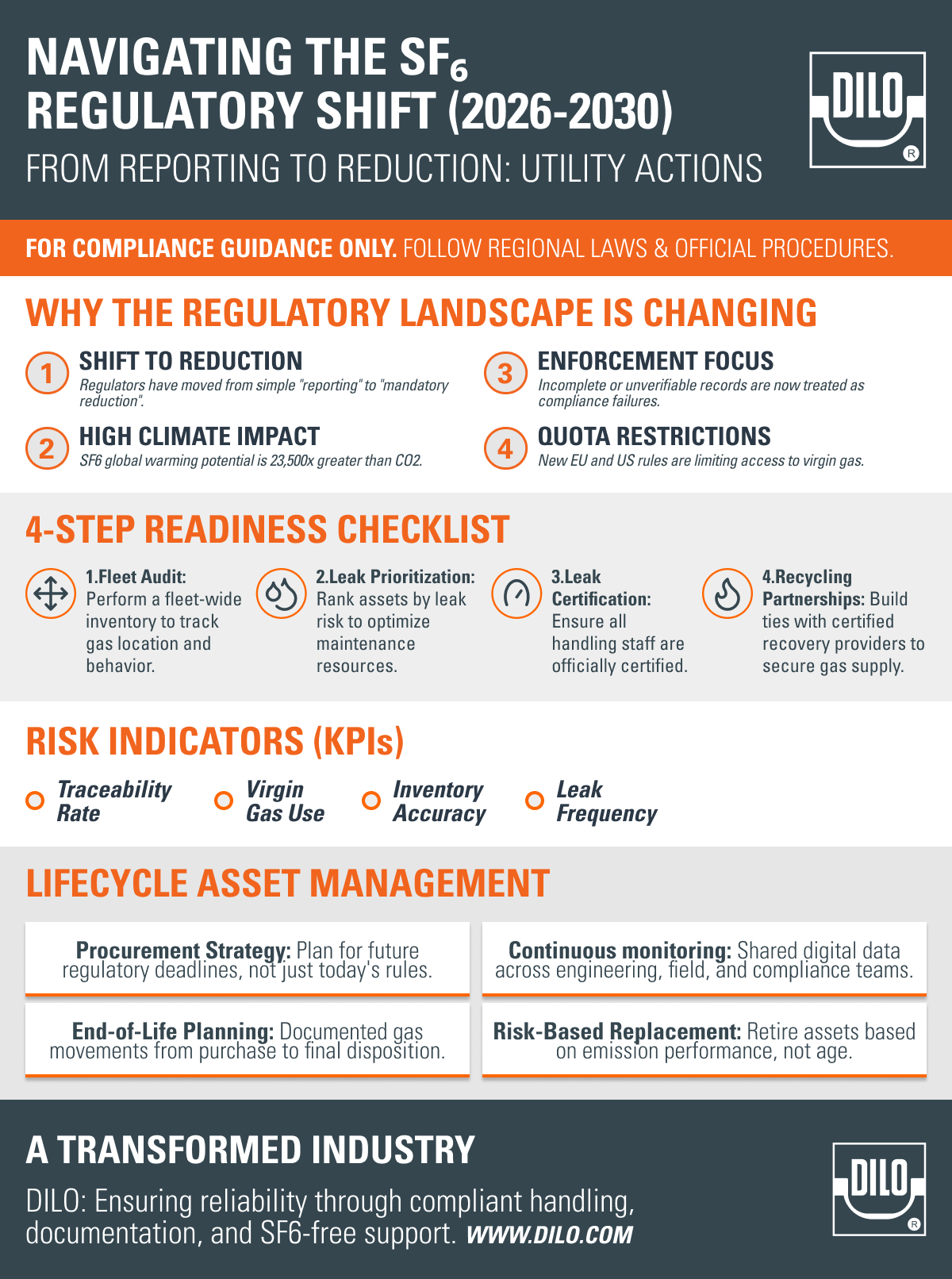

Between 2026 and 2030, that growth logic is changing. Expansion alone is no longer the dominant force shaping procurement decisions. Instead, SF6 regulations are becoming the primary driver of when and how utilities invest in gas-insulated equipment, and whether they invest at all.

The installed base of SF6-filled equipment remains enormous, particularly at high-voltage levels, where alternatives remain technically limited. However, the market is beginning to diverge sharply by region. Europe is moving aggressively toward restriction and phase-down. The United States is tightening reporting and accountability. Asia-Pacific markets are growing rapidly but under increasing environmental scrutiny. Emerging markets continue to expand capacity but face indirect regulatory pressure through OEM supply chains.

Forecasting demand in this environment has become increasingly unreliable. Regulatory uncertainty disrupts capital expenditure cycles, delays procurement, and forces utilities to reconsider long-term asset strategies. The result is not a simple decline in gas-insulated equipment, but a regulation-driven transformation of the entire industry.

Why SF6 Regulations Are Tightening: Climate, Compliance, and Political Pressure

SF6 is regulated not because it is toxic or flammable, but because of its climate impact. With a global warming potential exceeding 23,500 times that of CO₂ and an atmospheric lifetime measured in millennia, even small emissions carry disproportionate environmental weight.

Early regulatory approaches focused on reporting. Utilities were required to track inventories and disclose emissions, but there was limited pressure to reduce them. That phase has ended. Regulators have now shifted decisively from reporting to reduction and phase-down.

In the European Union, this logic is codified in the revised F-Gas Regulation, which reduces allowable fluorinated gas quotas and places increasing restrictions on new equipment containing SF6. In the United States, SF6 is now formally treated as a regulated greenhouse gas under federal rules, with state-level authorities, most notably California, pushing further.

International technical bodies such as IEC and CIGRE are influencing how these policies translate into engineering practice, redefining acceptable leakage rates, testing procedures, and lifecycle documentation. What has not happened, however, is global harmonization. Regulations vary widely by region, creating procurement challenges for OEMs and compliance complexity for multinational utilities.

Breakdown of Key SF6 Gas Regulations by Region

European Union: F-Gas Regulation (EU) 2024/573

The EU represents the most aggressive regulatory environment for SF6. The revised F-Gas Regulation introduces a phased reduction of fluorinated gas quotas, tighter reporting obligations for transmission and distribution system operators, and increasing restrictions on new installations containing SF6 later in the decade.

While high-voltage equipment retains certain exemptions, those exemptions are narrowing and subject to review. Utilities must now demonstrate proper recovery, recycling, and reuse practices, and personnel handling SF6 must be certified. These requirements directly affect procurement timelines, maintenance planning, and end-of-life costs.

United States: EPA and State-Level Rules

In the U.S., SF6 regulation is tightening through a combination of federal and state mechanisms. Under the EPA’s Greenhouse Gas Reporting Program, utilities must report SF6 emissions with increasing accuracy and consistency. Leak-rate thresholds are under closer scrutiny, and penalties for inaccurate inventories are becoming more severe.

State-level regulation, particularly in California, is driving the debate beyond reporting toward actual reduction and phase-down. While a nationwide ban is unlikely in the near term, utilities can no longer assume regulatory stability over the life of new SF6-based assets. More information on reporting obligations is available through the EPA’s Greenhouse Gas Reporting Program.

Asia-Pacific: Japan, Korea, and China

Japan has long maintained strict reporting and documentation practices for SF6, making it one of the most disciplined markets globally. Korea is in the earlier stages of formal reduction programs, but is aligning its environmental policy more closely with international standards.

China presents a more complex picture. It remains the fastest-growing GIS market due to massive grid expansion, yet environmental policy pressure is increasing. While outright restrictions are unlikely in the short term, OEMs supplying the Chinese market are already adapting designs to meet stricter global expectations.

Middle East and Latin America

In the Middle East and parts of Latin America, grid expansion remains the dominant driver of demand. SF6 regulations are currently less strict, but this does not insulate these regions from change. Global OEMs increasingly apply uniform design and leakage standards across all markets, effectively exporting regulatory pressure through supply chains.

Manufacturing Implications

SF6 regulations are reshaping the manufacturing of gas-insulated equipment at a fundamental level. Design teams are no longer optimizing primarily for electrical performance and footprint. Instead, leakage control and full lifecycle traceability have become core engineering constraints.

Lower permissible leakage rates are forcing OEMs to revisit multiple aspects of equipment design, including:

- enclosure geometry and flange interfaces

- sealing strategies and gasket materials

- machining tolerances on pressure-retaining components

Advanced sealing compounds capable of withstanding long-term thermal cycling are increasingly replacing legacy elastomers, particularly in applications subject to wide temperature variation.

Factory acceptance testing has also become significantly more demanding. In addition to standard dielectric and mechanical tests, manufacturers are now expected to perform:

- extended gas-tightness verification

- pressure decay testing over longer observation periods

- documented leak checks before shipment

These additional steps are time-intensive and require specialized instrumentation and trained personnel. The result is higher labor cost per unit and longer production lead times, particularly for large GIS and GIL assemblies.

At the same time, SF6 sourcing itself is becoming a material constraint. In regions subject to quota systems, most notably the European Union, access to virgin SF6 is no longer guaranteed at predictable prices or delivery timelines. This uncertainty complicates production planning and inventory management, especially for projects requiring large gas volumes.

OEMs are increasingly responding by relying on reclaimed and recycled SF6. While this approach reduces dependency on virgin gas, it introduces new challenges, including:

- stricter gas quality verification requirements

- additional purification and handling steps

- expanded documentation and traceability obligations

Taken together, these pressures are increasing unit costs, extending certification timelines, and reducing manufacturers’ ability to respond quickly to sudden demand changes. Equipment availability is becoming less elastic, which directly affects utilities' planning for grid upgrades under fixed regulatory and decarbonization deadlines.

Operational Implications for Utilities

For utilities, regulatory compliance now extends across the entire operational phase of gas-insulated assets. Installation is no longer the endpoint of regulatory responsibility; it marks the beginning of a documented compliance lifecycle that spans decades of operation.

Utilities are increasingly expected to implement structured, repeatable processes that include:

- defined leak detection schedules aligned with regulatory expectations

- continuously updated SF6 inventories tied to individual assets

- emissions reporting within prescribed timeframes using standardized methodologies

Critically, enforcement focus is shifting. Regulators are no longer evaluating performance based solely on measured emissions. Incomplete, inconsistent, or unverifiable records are now treated as compliance failures in their own right. An undocumented gas loss can carry consequences comparable to a confirmed leak, particularly during audits or inspections.

This shift is forcing utilities to formalize sf6 gas handling procedures across all operational activities. Routine maintenance, corrective repairs, and emergency interventions are now expected to follow the same documented handling standards, regardless of urgency or operational pressure. Informal or crew-specific practices are increasingly viewed as unacceptable risk.

As a result, traditional operational silos are breaking down. Engineering teams, field crews, and compliance departments must share data and align workflows. Digital tools are becoming central to this coordination, including:

- centralized SF6 inventory and tracking systems

- automated gas density and pressure monitoring

- standardized digital maintenance and intervention records

Utilities that continue to rely on manual logs, spreadsheets, or fragmented record-keeping systems are exposed to compliance risk, even when actual emissions remain low. In the current regulatory environment, demonstrated control and traceability matter as much as physical performance.

End-of-Life and Asset Replacement

End-of-life obligations are increasingly influencing asset strategy well before decommissioning occurs. Utilities must now plan for the controlled removal, recovery, purification, and final disposition of SF6 as part of the procurement decision itself. Regulators expect full traceability of gas movements, often spanning decades, with clear documentation linking recovered gas to its original asset.

These requirements shift cost considerations forward in time. Equipment that appears economical at purchase may impose significant financial and administrative burdens at retirement. As a result, end-of-life compliance is becoming a weighted factor in total cost of ownership calculations, alongside reliability and maintenance performance.

How Regulations Are Reshaping SF6 Breaker and GIS/GIL Technology

Regulatory pressure is translating directly into engineering change. GIS and SF6 breaker designs are being re-evaluated to minimize sealing surfaces, reduce potential leak paths, and improve long-term stability. Advanced polymer seals that better tolerate thermal cycling are replacing older elastomers, and density monitoring systems are becoming more sophisticated and more digital.

Many OEMs are integrating IoT-based leakage detection and stricter acceptance testing before commissioning. However, claims of “low-leak” or “near-zero emission” designs should be treated cautiously. Field performance varies significantly by climate, installation quality, and maintenance discipline. Not all designs perform equally well outside controlled environments.

Alternatives to SF6: Progress and Practical Limitations

Considerable effort is being invested in alternatives to SF6, including fluoronitrile-based gas mixtures, fluoroketones, clean air systems, and hybrid gas-insulated designs. These technologies are gaining regulatory support, particularly in Europe.

Yet practical limitations remain. Cold-weather performance continues to be a challenge for several alternatives, especially at higher voltages. Scalability beyond 145 kV at higher current ratings are limited, operating pressures are often higher, and long-term field data is still scarce. Cost remains a significant barrier for emerging markets, and regulatory approval is not globally harmonized.

As a result, alternatives will grow, but they will not replace SF6 universally by 2030.

SF6 Emissions Reduction Strategies Utilities Must Implement (2026–2030)

For most utilities, the most effective path forward is emissions reduction without wholesale equipment replacement. Precision leak detection, using both handheld instruments and continuous monitoring, has become essential. High-quality recovery, purification, and reuse processes reduce both emissions and dependence on new gas supply.

Intelligent lifecycle tracking systems allow utilities to document compliance and identify high-risk assets. Maintenance protocols are evolving to emphasize seal quality, torque verification, and environmental protection. Technician certification is increasingly mandatory, and digital inventory systems are replacing manual logs.

For many fleets, prioritizing replacement based on asset risk rather than age delivers the most significant emissions reduction per dollar invested. Detailed guidance on breaker-specific handling is also available through resources such as this overview of SF6 Gas Circuit Breaker practices.

How Utilities and Operators Should Prepare for Future SF6 Regulations

Preparation begins with a fleet-wide inventory audit. Utilities need to know precisely how much SF6 they own, where it is located, and how it is behaving over time. Establishing a leak-priority ranking system allows maintenance resources to be allocated where they have the greatest impact.

Investment in training and certified handling personnel is no longer optional. Procurement strategies should explicitly account for future regulatory deadlines, not just current rules. Continuous gas density monitoring systems reduce uncertainty and support compliance reporting.

Finally, utilities should build partnerships with certified recovery and recycling providers and establish digital documentation processes that can withstand regulatory audits.

Future Outlook: Will SF6 Be Fully Eliminated or Just Controlled More Tightly?

Will SF6 be entirely eliminated? The answer, at least through 2030, is no. In the EU, near-elimination is likely for many medium-voltage applications. At high voltage, particularly above 145 kV, SF6 will remain challenging to replace in many regions.

Regulators understand that grid reliability is non-negotiable, especially during the energy transition. As a result, the most likely outcome is not a universal ban, but hybrid regulatory regimes that tightly control SF6 while allowing its use where alternatives are not yet viable.

The adoption of SF6-free technologies will vary by climate, grid topology, and economic context. Utilities that assume a one-size-fits-all future risk are unprepared.

Final Perspective

Between 2026 and 2030, SF6 regulations will reshape the global gas-insulated power equipment market more profoundly than any single technological trend. Compliance burdens will increase, technology choices will narrow, and lifecycle accountability will become central to asset management.

The industry is not moving toward the immediate disappearance of SF6, but toward a world where its use is tightly justified, meticulously documented, and aggressively minimized. Utilities and OEMs that recognize this shift and act early will be better positioned to manage risk, control costs, and maintain grid reliability in an increasingly regulated environment.

Preparing for tighter SF₆ regulations starts with understanding your current risk.

Review your fleet inventory, emissions tracking, and handling practices now to avoid compliance surprises later in the decade. If you’d like support evaluating your fleet inventory, emissions tracking, or gas-handling practices, contact DILO to speak with experts who work with utilities and operators navigating SF₆ compliance every day.